maine property tax calculator

Maine charges a progressive income tax broken down into three tax brackets. The Maine state sales tax rate is 55 and the average ME sales tax after local surtaxes is 55.

Maine Property Tax Rates By Town The Master List

Except for a few statutory exemptions all vehicles registered in the State of Maine are subject to the excise tax.

. The amounts shown are based on percentages derived from the approved FY19 Town of Hampden budget. Maine has a 55 statewide sales tax rate and does not allow local governments to collect sales taxes. The state of Maine publishes this information in a PDF but wanted to be able to sort by mil rate county growth rate and current mil rate.

The tax rates range from 58 on the low end to 715 on the high end. Generally property taxes are higher in the more southern and urban counties in Maine. In short if the vehicle is registered in the state of Maine then the Maine car sales tax of 550 will be applied.

Our Maine Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Maine and across the entire United States. Overview of Maine Taxes Maine has a progressive income tax system that features rates that range from 580 to. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in Cumberland County.

The average rate in Maine is 109 18th in the country. Maine is ranked number twenty out of the fifty states in order of the average amount of property taxes collected. Maine property tax calculator A salary of 80000 in Gilbert Arizona could decrease to 54214 in Augusta Maine assumptions include Homeowner no Child Care and Taxes are not considered.

Municipal Services and the Unorganized Territory. The median property tax on a 24840000 house is 270756 in Maine. Counties in Maine collect an average of 109 of a propertys assesed fair market value as property tax per year.

Below we have highlighted a number of tax rates ranks and measures detailing Maines income tax business tax sales tax and property tax systems. The median property tax on a 24840000 house is 260820 in the United States. Excise tax is defined by Maine law as a tax levied annually for the privilege of operating a motor vehicle or camper trailer on the public ways.

The Maine State Tax Tables for 2021 displayed on this page are provided in support of the 2021 US Tax Calculator and the dedicated 2021 Maine State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state. So the tax year 2021 will start from July 01 2020 to June 30 2021. Maine tax year starts from July 01 the year before to June 30 the current year.

Groceries and prescription drugs are exempt from the Maine sales tax. The first step towards understanding Maines tax code is knowing the basics. Our division is responsible for the determination of the annual equalized full value state valuation for the 484 incorporated municipalities as well as for the unorganized territory.

Each spending category below corresponds to a Town budget category. Maine Property Tax Calculator to calculate the property tax for your home or investment asset. Now that were done with federal taxes lets look at Maines state income taxes.

The car sales tax in Maine is 550 of the purchase price of the vehicle. Calculating your Maine tax year income tax is similar to the steps we outlined on our Federal paycheck calculator. For example if you purchase a new vehicle in Maine for 40000 then you will.

The Maine income tax calculator is designed to provide a salary example with salary deductions made in Maine. The state valuation is a basis for the allocation of money. Property taxes are 351 of income in Maine 17th highest in the country.

This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. The Property Tax Division is divided into two units.

The ME Tax Calculator calculates Federal Taxes where applicable Medicare Pensions Plans FICA Etc allow for single joint and head of household filing in MES. Each states tax code is a multifaceted system with many moving parts and Maine is no exception. The typical Maine resident will pay 2597 a year in property taxes.

The median income in Maine is 56277. Maine Property Tax Calculator. The states average effective property tax rate is 130 while the national average is currently around 107.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. This means that the applicable sales tax rate is the same no matter where you are in Maine. This state sales tax also applies if you purchase the vehicle out of state.

There is option to include cost of repairsimprovement that you might have incurred during the holding. The median property tax in Maine is 193600 per year for a home worth the median value of 17750000. The median property tax in maine is 193600 per year for a home worth the median value of 17750000.

2022 Maine state sales tax. Property tax is calculated based on your home value and the property tax rate. Maine property tax calculator.

The Maine tax calculator is updated for the 202122 tax year. Excise tax is an annual tax that must be paid prior to registering your vehicle. Figure out your filing status.

Maine State Payroll Taxes. Exact tax amount may vary for different items. How does Maine rank.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Are you looking to move to a town or city in Maine but also want to get a sense of what the property tax or mil rate isYouve come to the right place. The annual appreciation is an optional field where you can enter 0 if you do not wish to include it in the ME property tax calculator.

The state valuation is a basis for the allocation of money. This state sales tax also applies if you purchase the vehicle out of state. Property tax rates in Maine are well above the US.

The Maine Department of Revenue is responsible for publishing the latest Maine State. I created this page after constantly Googling the rates. Overview of Maine Taxes.

The interactive calculator below allows property tax payers to enter the amount of their annual bill to learn how those dollars are allocated to various Town expenses. Counties and cities are not allowed to collect local sales taxes. To use our Maine Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

After a few seconds you will be provided with a full breakdown of the tax you are paying.

The Cook County Property Tax System Cook County Assessor S Office

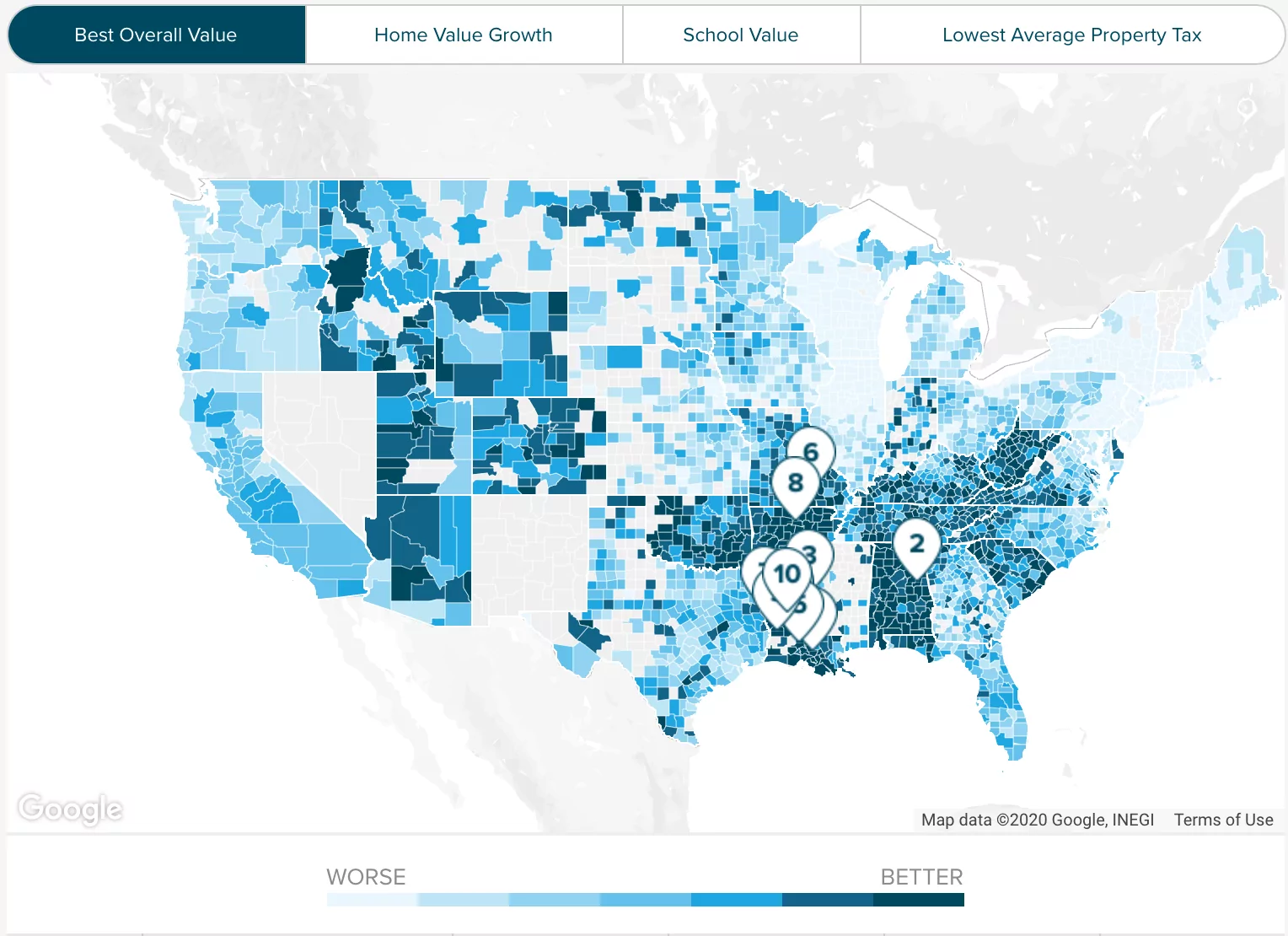

Map The Most And Least Tax Friendly States Best Places To Retire Retirement Locations Map

Paradym Fusion Viewer Beautiful Lakes Property Tax Boat Storage

Lake Cumberland Real Estate Professionals Real Estate Professionals Real Estate Estates

U S Cities With The Longest Names University Of Rhode Island Spelling Bee Names

Orange City S Total Property Tax Levy Rate Ranks 551st In The State Orange City

Pennsylvania Property Tax H R Block

Property Tax Comparison By State For Cross State Businesses

Comparing The Real Cost Of Owning Property Across The United States Property Tax Real Estate Staging Denver Real Estate

43 Kenion Avenue Waterfront Homes Maine House Upstairs Master Suite

2292 N Fulton Beach 104 Home Buying Square Feet Property Tax

Maine Property Tax Calculator Smartasset

Paradym Fusion Viewer Kaizen Long House Maine House

Maine Property Tax Calculator Smartasset

Harris County Tx Property Tax Calculator Smartasset

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

6115 Parker Real Estate Investment Property Property

Property Tax In Delhi Circle Rate In Delhi Property In Delhi Property Advisor Property Agent Property Buyer Property Buyers Sell House Fast Property Guide